Working Papers

Designing High-Frequency Market Liquidity Measures with Applications to Monetary Policy, with Oliver Linton, Yunxiao Zhai, and Haotian Zhang. • Supplement

Abstract: We propose a new family of liquidity measures—including order imbalance metrics—based on the dispersion and persistence of transitory gaps between transaction prices and the underlying efficient price. We devise an estimation method that renders these latent gaps observable, allowing plug-in estimates of the new measures from intraday trades alone, along with an inference method that allows us to quantify the sampling uncertainty in our estimates. We apply the approach to the S&P 500 equity portfolio, as well as to individual stocks. We use event study methodology to capture heterogeneous liquidity responses to FOMC announcements, which reveals distinct order-persistence patterns on surprise versus non-surprise days, highlighting how markets anticipate and react to monetary policy via the liquidity channel.

Empirical Highlights:

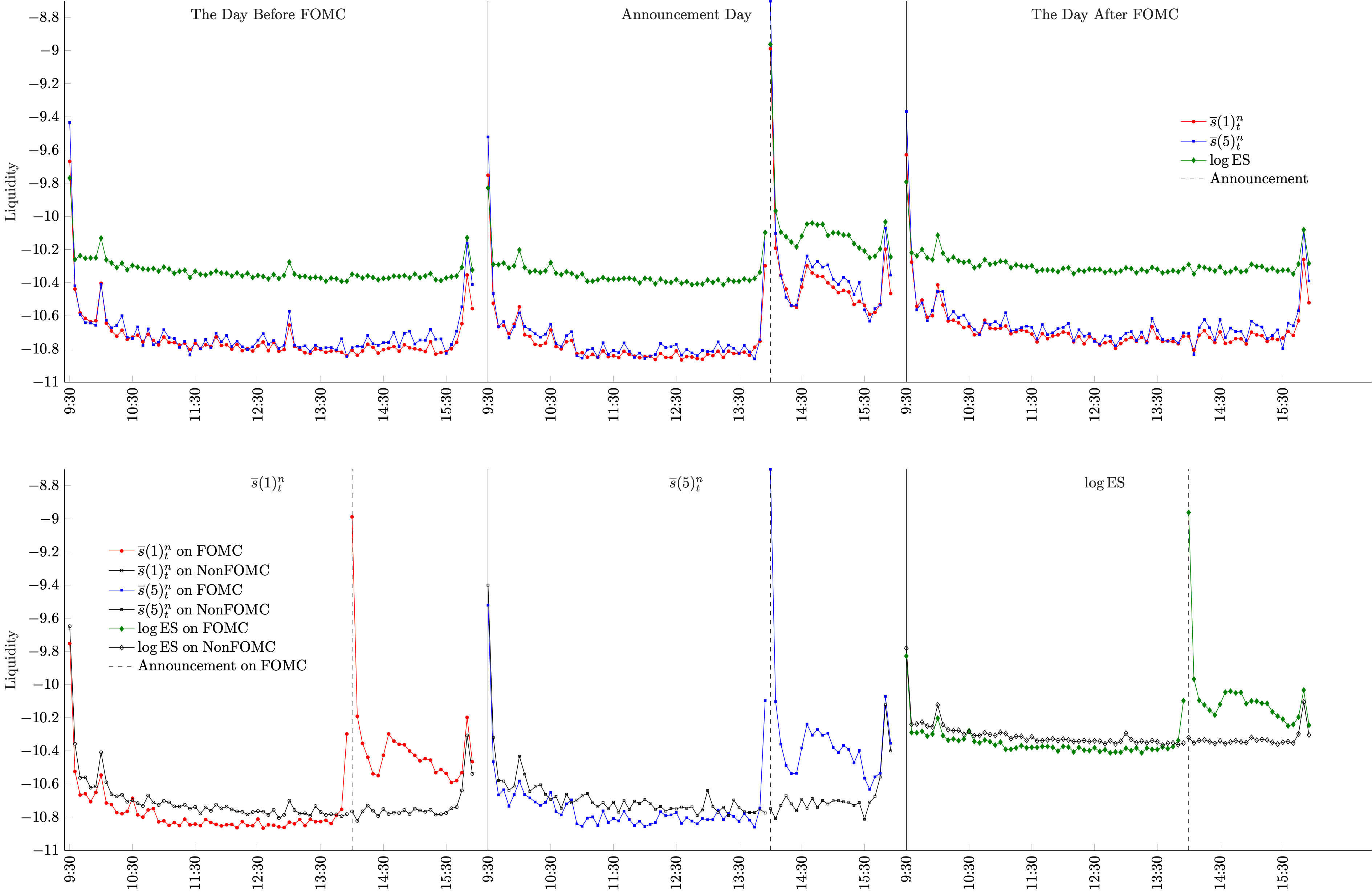

Figure: Liquidity Dynamics Around FOMC Announcements at 14:00. The top panel displays averaged log-estimates of proposed liquidity measures (${\mathcal{S}}(m)^n_t$ for $m=1,5$) alongside the log effective spread (ES), grouped by trading days prior to, during, and after FOMC announcements. The bottom panel contrasts these measures on FOMC days with estimates from non-FOMC days (control groups), represented by black dotted lines.

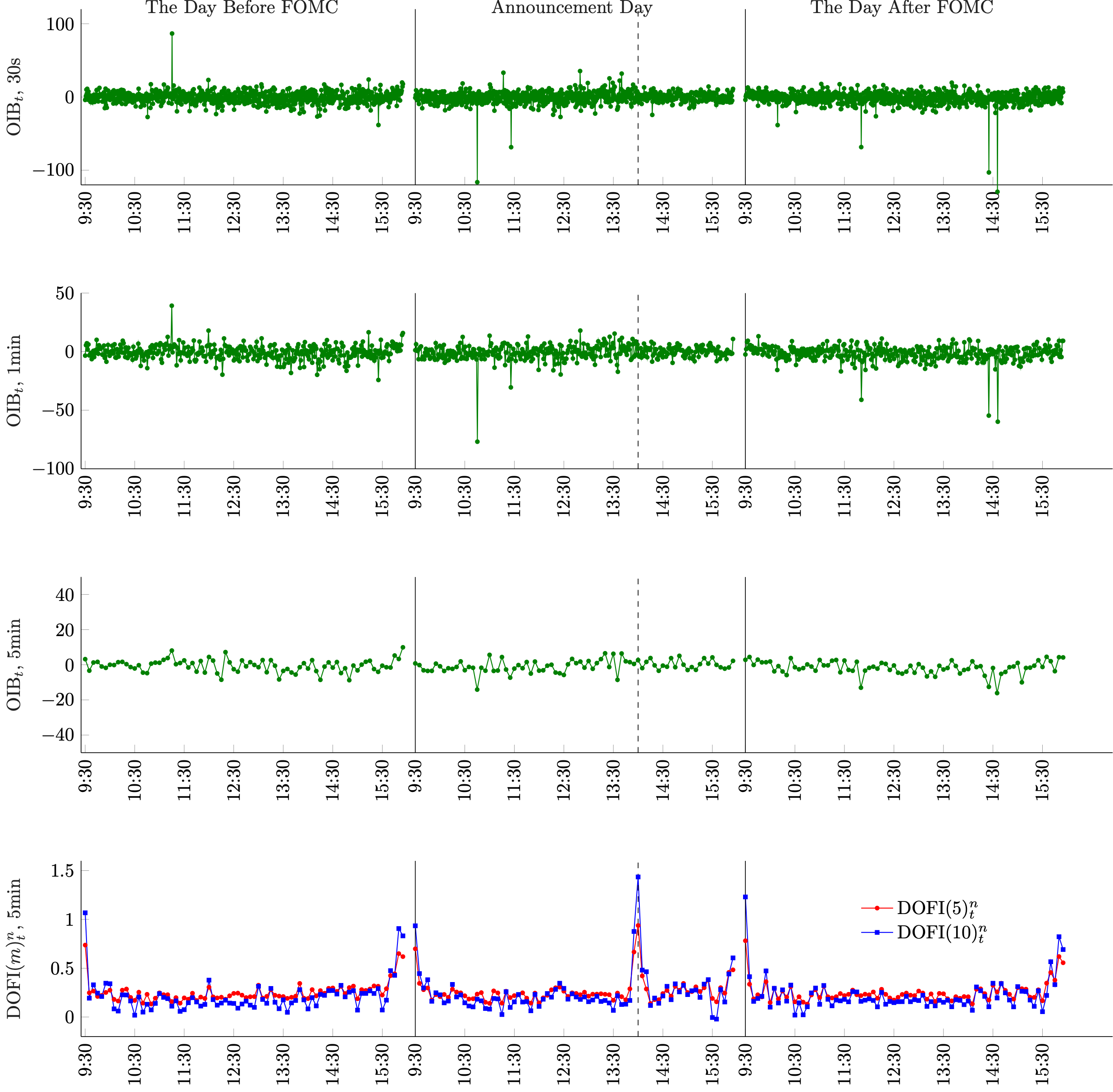

Figure: Liquidity Dynamics Around FOMC Announcements at 14:00. The top panel displays averaged log-estimates of proposed liquidity measures (${\mathcal{S}}(m)^n_t$ for $m=1,5$) alongside the log effective spread (ES), grouped by trading days prior to, during, and after FOMC announcements. The bottom panel contrasts these measures on FOMC days with estimates from non-FOMC days (control groups), represented by black dotted lines. Figure: Order Imbalance Measures Around FOMC Announcements at 14:00. The top panel displays average standard order imbalance measures prior to, during, and after FOMC announcements days. The bottom panel plots our proposed new order imbalance measures DOFI(m) with $m=5, 10$.

Figure: Order Imbalance Measures Around FOMC Announcements at 14:00. The top panel displays average standard order imbalance measures prior to, during, and after FOMC announcements days. The bottom panel plots our proposed new order imbalance measures DOFI(m) with $m=5, 10$.